Chief Financial Officer | Board Member Resume Template

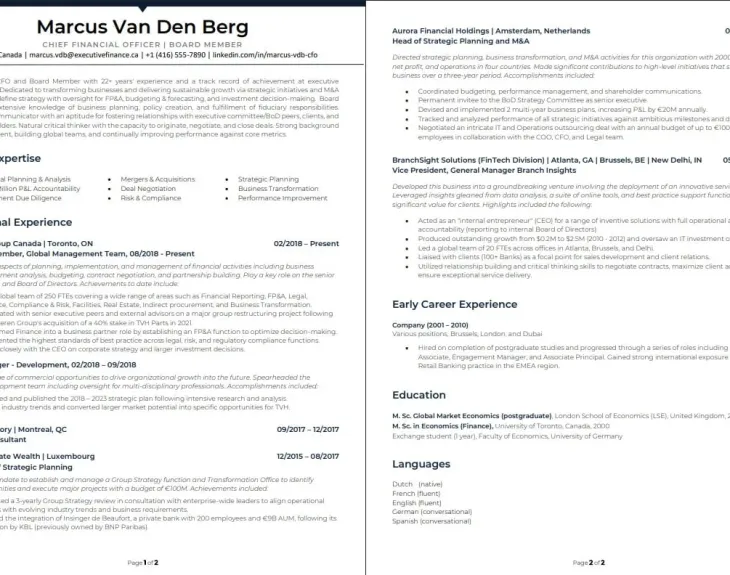

Marcus Van Den Berg

CHIEF FINANCIAL OFFICER | BOARD MEMBER

Toronto, Canada | [email protected] | +1 (416) 555-7890 | linkedin.com/in/marcus-vdb-cfo

Results-driven CFO and Board Member with 22+ years’ experience and a track record of achievement at executive leadership level. Dedicated to transforming businesses and delivering sustainable growth via strategic initiatives and M&A activity. Able to define strategy with oversight for FP&A, budgeting & forecasting, and investment decision-making. Board Member with extensive knowledge of business planning, policy creation, and fulfillment of fiduciary responsibilities. Collaborative communicator with an aptitude for fostering relationships with executive committee/BoD peers, clients, and external stakeholders. Natural critical thinker with the capacity to originate, negotiate, and close deals. Strong background in developing talent, building global teams, and continually improving performance against core metrics.

Areas of Expertise

| · Financial Planning & Analysis

· Multi-Million P&L Accountability · Investment Due Diligence |

· Mergers & Acquisitions

· Deal Negotiation · Risk & Compliance |

· Strategic Planning

· Business Transformation · Performance Improvement |

Professional Experience

CleanTech Group Canada | Toronto, ON 02/2018 – Present

CFO, Board Member, Global Management Team, 08/2018 – Present

Orchestrate all aspects of planning, implementation, and management of financial activities including business modeling, investment analysis, budgeting, contract negotiation, and partnership building. Play a key role on the senior leadership team and Board of Directors. Achievements to date include:

Interim Manager – Development, 02/2018 – 09/2018

Identified a range of commercial opportunities to drive organizational growth into the future. Spearheaded the Corporate Development team including oversight for multi-disciplinary professionals. Accomplishments included:

FinEdge Advisory | Montreal, QC 09/2017 – 12/2017

Freelance Consultant

Valentine Private Wealth | Luxembourg 12/2015 – 08/2017

Group Head of Strategic Planning

Hired with a mandate to establish and manage a Group Strategy function and Transformation Office to identify growth opportunities and execute major projects with a budget of €100M. Achievements included:

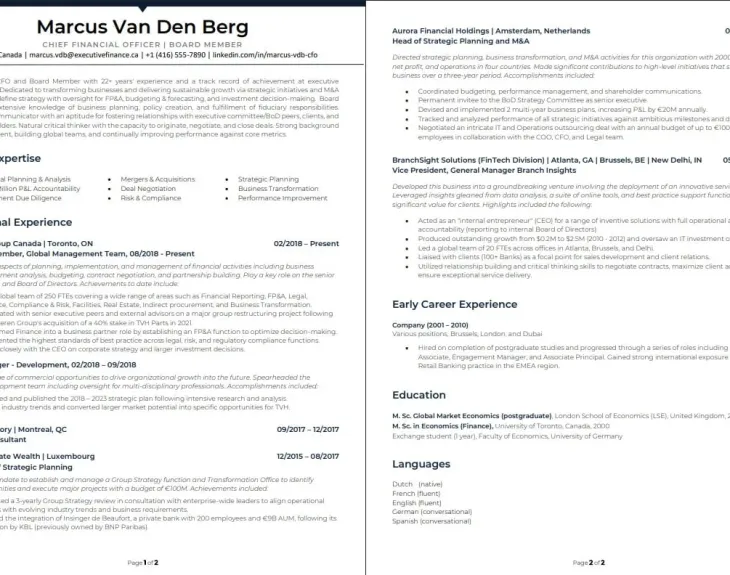

Aurora Financial Holdings | Amsterdam, Netherlands 02/2013 – 11/2015

Head of Strategic Planning and M&A

Directed strategic planning, business transformation, and M&A activities for this organization with 2000 FTEs, €100M net profit, and operations in four countries. Made significant contributions to high-level initiatives that shaped the business over a three-year period. Accomplishments included:

BranchSight Solutions (FinTech Division) | Atlanta, GA | Brussels, BE | New Delhi, IN 05/2010 – 12/2012

Vice President, General Manager Branch Insights

Developed this business into a groundbreaking venture involving the deployment of an innovative service model. Leveraged insights gleaned from data analysis, a suite of online tools, and best practice support functionality to add significant value for clients. Highlights included the following:

Early Career Experience

Company (2001 – 2010)

Various positions, Brussels, London, and Dubai

Education

Exchange student (1 year), Faculty of Economics, University of Germany

Languages

Dutch (native)

French (fluent)

English (fluent)

German (conversational)

Spanish (conversational)

At Resume Writing Lab, our CFO resume writers frequently advise senior executives, especially CFOs and Board Members, on crafting resumes that truly reflect their career achievements, leadership qualities, and strategic impact. Using Marcus Van Den Berg’s impressive resume as an illustration, we will guide you through each key section, sharing insights into why and how you should structure your resume similarly.

Begin your resume with your full name and professional title prominently displayed, making your seniority and specialization immediately clear:

“Marcus Van Den Berg | Chief Financial Officer | Board Member”

This clarifies your executive presence from the first glance.

Your professional summary should offer a succinct yet powerful snapshot of your career. Highlight your years of experience, leadership competencies, and key strengths:

“Results-driven CFO and Board Member with 22+ years’ experience and a track record of achievement at executive leadership level.”

Demonstrating clear metrics and specific skills instantly underscores your suitability for executive roles.

List your core competencies clearly to allow hiring committees to easily match your skills with role requirements. Using short, powerful keywords helps optimize your resume for Applicant Tracking Systems (ATS):

“Financial Planning & Analysis | Mergers & Acquisitions | Risk & Compliance”

These specific competencies showcase depth and versatility.

Structure your professional experiences to highlight not only your responsibilities but also quantifiable results. Clearly define your role and outline concrete achievements:

“Lead a global team of 250 FTEs covering Financial Reporting, FP&A, Legal, Assurance, Compliance & Risk…”

As professional finance resume writers recommend, stating exact numbers illustrates your scope of responsibility and leadership impact.

Clearly articulate your strategic initiatives and collaborative efforts to show your effectiveness at the executive level:

“Collaborated with senior executive peers and external advisors on a major group restructuring project…”

This showcases your ability to effectively operate at the highest organizational levels.

Executives must demonstrate their capability to drive significant organizational transformation. Clearly specify your achievements in this area:

“Transformed Finance into a business partner role by establishing an FP&A function to optimize decision-making.”

Such statements strongly demonstrate your value and strategic vision.

Mergers and acquisitions often define a CFO’s strategic influence. Clearly articulate your role in critical transactions:

“Managed the integration of Insinger de Beaufort, a private bank with 200 employees and €9B AUM…”

Quantifiable achievements clearly illustrate your direct impact and leadership in complex financial scenarios.

Short-term roles or consultancy projects are valuable and demonstrate adaptability, strategic insight, and versatility:

“Interim Manager – Development: Identified commercial opportunities to drive organizational growth…”

Such experiences further underscore your strategic agility and leadership capacity.

Clearly outline how you advanced through roles, as it portrays your career trajectory and growth:

“Gained strong international exposure and co-led the Retail Banking practice in the EMEA region.”

Early-career leadership positions underscore a consistent upward trajectory.

Highlight your educational background prominently, along with any additional language proficiencies, underscoring your readiness for global leadership:

“M.Sc. Global Market Economics, London School of Economics (LSE)”

“Languages: Dutch (native), French (fluent), English (fluent), German (conversational)”

Such details indicate international versatility and strong communication capabilities.

Integrate relevant keywords organically throughout your resume. Terms like “strategic planning,” “M&A,” “FP&A,” and “risk management” help ensure your resume navigates ATS filters effectively, increasing visibility to recruiters.

At Resume Writing Lab’s executive resume writing services, we help senior financial executives like you craft personalized resumes that resonate strongly with corporate decision-makers. Follow this guide, reflecting Marcus Van Den Berg’s exceptional presentation style, to showcase your unique executive journey clearly and convincingly.